Content

Relationship-based ads and online behavioral advertising help us do that. Content contained herein may have been produced by an outside party that is not affiliated with Bank of America or any of its affiliates . Opinions or ideas expressed are not necessarily those of Bank of America nor do they reflect their views or endorsement. Bank of America does not assume liability for any loss or damage resulting from anyone’s reliance on the information provided. Certain links may direct you away from Bank of America to an unaffiliated site. Bank of America has not been involved in the preparation of the content supplied at the unaffiliated sites and does not guarantee or assume any responsibility for its content. When you visit these sites, you are agreeing to all of their terms of use, including their privacy and security policies.

What are examples of financial statements?

The primary financial reports are: the profit and loss statement, balance sheet and statement of cash flow. To see what these statements look like, start with the financial data from ABC Corp. Using this information, you can figure out how to prepare several examples of financial statements: Sales: $3,200,000.

On the other hand, a small Etsy shop might only get a balance sheet every three months. Earn up to $300 When you open and use a new Virtual Wallet® product. $100 or 50,000 Bonus Points When you open and use select, new credit cards.

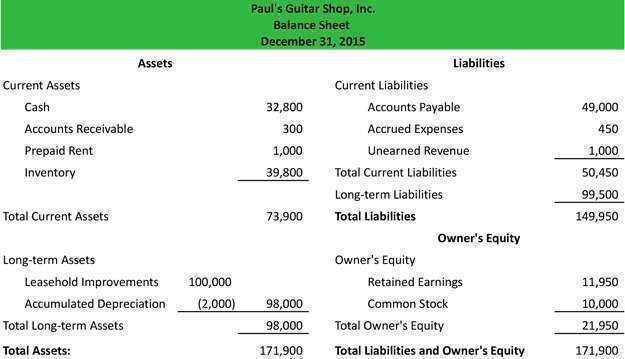

In either case, your cash flow statement has shown you a different side of your business—the cash flow side, which is invisible on your balance sheets and income statements. The balance sheet is prepared after the income statement is closed and reflects any profit or loss from the period’s activity. The amounts shown on the balance sheet are the ending balances in the asset, liability, and owner’s equity accounts “as of” the end of the reporting period. Unlike the income statement accounts, these amounts are not set to zero. The ending balances in these accounts become the beginning balances in the next reporting period. A company’s balance sheet is set up like the basic accounting equation shown above. On the left side of the balance sheet, companies list their assets.

Accountingtools

Cash flows provide more information about cash assets listed on a balance sheet and are related, but not equivalent, to net income shown on the income statement. But combined, they provide very powerful information for investors. And information is the investor’s best tool when it comes to investing wisely. The SEC’s rules governing MD&A require disclosure about trends, events or uncertainties known to management that would have a material impact on reported financial information. The purpose of MD&A is to provide investors with information that the company’s management believes to be necessary to an understanding of its financial condition, changes in financial condition and results of operations.

As blockchain technology evolves, there are opportunities for blockchains to significantly improve financial and clinical operations in healthcare. Q&A with Bobbi Brown Register for our free Small Business Month webinar and automatically be entered for a chance to win $25,000! Earn $200 When you open and use a new, qualifying business checking account.

Turning stablecoin issuers into banks is a recipe for disaster TheHill – The Hill

Turning stablecoin issuers into banks is a recipe for disaster TheHill.

Posted: Tue, 23 Nov 2021 21:01:05 GMT [source]

The income statement shows the financial margin or net interest margin. This margin is the derivative of activity from using funds from spending units that are capable of financing to grant loans to those in need of financing. Its value is equivalent to the difference between the products and financial costs, and institutions’ strategy is to obtain the lowest cost for others’ money and the highest income from funds lent to third parties.

All else being equal, a decline in the value of a bank’s assets will result in a corresponding decline in its capital. If losses are particularly large, the bank’s capital will be wiped out, leaving the bank insolvent. Thus, the regulation of bank capital rests on the fact that an adequate capital cushion is essential if banks are to be able to absorb their losses while at the same time fulfilling their promise to pay back creditors. Annual financial statements or other information on the various parties to the project. “Bank of America” is the marketing name for the global banking and global markets business of Bank of America Corporation. BofA Securities, Inc., Merrill Lynch, Pierce, Fenner & Smith Incorporated and Merrill Lynch Professional Clearing Corp. are registered as futures commission merchants with the CFTC and are members of the NFA.

Financial Statements For Banks: Balance Sheet

The sum of the net interest margin plus the commissions for services provided is called core revenue. Some authors feel it is appropriate to introduce loan loss provisions in the net interest margin, as provisions for non-performing or questionable loans means lower returns from lending. Being a community bank means being open and transparent to the communities Central Bank serves. Please feel free to review our quarterly statements and annual reports. Keeping you informed about our bank’s financial strength is Central to us – and Central to you. Most countries have a central bank, where most national banks will store their money and profits.

- Marketable securities are unrestricted short-term financial instruments that are issued either for equity securities or for debt securities of a publicly listed company.

- BofA Securities, Inc., Merrill Lynch, Pierce, Fenner & Smith Incorporated and Merrill Lynch Professional Clearing Corp. are registered as futures commission merchants with the CFTC and are members of the NFA.

- In addition, it contains the cornerstones of our strategy and the key figures for the financial year 2019.

- David has helped thousands of clients improve their accounting and financial systems, create budgets, and minimize their taxes.

- This includes money the owner invested in the business, as well as taking out and repaying loans.

- You could be making a killing on every popsicle, but spending so much on advertising that you walk away with nothing.

- On the other hand, if the lessor is the economic owner, this is known as an ‘operating lease’ and the asset remains on the lessor’s balance sheet.

Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. © 2021 Copyright owned by one or more of the KPMG International entities. As a community bank, we also recognize the importance of service to others and encourage all of our employees to be involved in the local community. The Federal Deposit Insurance Corporation is an independent agency created by the Congress to maintain stability and public confidence in the nation’s financial system. Learn about the FDIC’s mission, leadership, history, career opportunities, and more. They may have trading liabilities, which consists of derivative liabilities and short positions. Our Accounting guides and resources are self-study guides to learn accounting and finance at your own pace.

The Cash Flow Statement

As the collateral can take either forms, arbitrage CDOs can be either CLOs or collateralised bond obligations . Market practitioners often refer to all arbitrage deals as CDOs for simplicity, irrespective of the collateral backing them.

The “charge” for using these assets during the period is a fraction of the original cost of the assets. Shareholders’ equity is the amount owners invested in the company’s stock plus or minus the company’s earnings or losses since inception. Sometimes companies distribute earnings, instead of retaining them.

Which financial statement is most important to bankers?

The income statement, balance sheet and cash flow statement are generally considered the most important documents for evaluating the financial state of a company.

There is also a corresponding interest-related income, or expense item, and the yield for the time period. On this page you will find the annual reports of Credit Suisse AG and the Credit Suisse AG Bank, as well as our Sustainability Report. Investor analysis of share value is largely based on cash flows, so they will have the greatest interest in the statement of cash flows.

What Are Financial Statements?

Peoples State Bank in Wisconsin offers a variety of personal and business banking products and services. Explore our checking accounts, savings accounts, small business loans, mortgages, wealth management services and much more. Bank online, with our mobile app, or visit one of our offices in Wausau, Weston, Marathon, Rhinelander, Minocqua, Eagle River, West Allis, Wauwatosa, or Stevens PointWI.

But suppose the cost of buying a new, top-of-the-line cart, one that has kevlar tank treads instead of rubber tires, is $600. You can calculate that, over the course of two years, it’ll pay for itself. This is money you invest—in this case, by purchasing new equipment for your business. This is what you make and spend in the normal course of doing business. CategoryAmountRevenueSales revenue$1,000COGS$100Gross Profit$900ExpensesInterest expense$100Electricity expense$50Maintenance expense$50You sold $1,000 worth of popsicles. If popsicles cost $4 each (they’re vegan, gluten-free, and organic, after all), that means you sold 250 popsicles.

An Inside Look At Bank Of America Corporation Bac

When you click links marked with the “‡” symbol, you will leave UMB’s website and go to websites that are not controlled by or affiliated with UMB. However, we do not endorse or guarantee any products or services you may view on other sites. Other websites may not follow the same privacy policies and security procedures that UMB does, so please review their policies and procedures carefully. We’re proud to go above and beyond banking to offer events just for you. Is a summary of the key differences between balance sheet arbitrage and CDOs. Two effects contribute to the divergence of a bank’s privately optimal capital ratio from the socially optimal capital ratio. Crucial to Modigliani and Miller’s theorem is the assumption of perfect markets.

They may have to lay off workers and close plants or go bankrupt altogether. Such weak balance sheets have increasingly been fingered in many models, not only as the major contractionary effect in a devaluation, but also as a fundamental cause of currency crises in the first place. That most CLOs have been issued by banks that are domiciled in the main developed economies, the geographical nature of the underlying collateral often have little connection with the home country of the originating bank. Most bank CLOs are floating-rate loans with average lives of five years or less. They are targeted mainly at bank sector Libor-based investors, and are structured with an amortising payoff schedule.

A Bank’s Activity Is In Its Balance Sheet

A bank balance sheet is a key way to draw conclusions regarding a bank’s business and the resources used to be able to finance lending. The volume of business of a bank is included in its balance sheet for both assets and liabilities . The main operations and source of revenue for banks are their loan and deposit operations. Customers deposit money at the bank for which they receive a relatively small amount of interest. The bank then lends funds out at a much higher rate, profiting from the difference in interest rates. Investors should monitor whether there’s an upward trend in loan-loss provisions as it might indicate that management expects an increasing number of problem loans.

These documents could provide a TON more detail than the tax returns alone would. E.g., the IRS work papers might include personal financial statements that he provided to banks.

— Catherine Rampell (@crampell) April 4, 2019

Likewise, paying back a bank loan would show up as a use of cash flow. These are expenses that go toward supporting a company’s operations for a given period – for example, salaries of administrative personnel and costs of researching new products. Operating expenses are different from “costs of sales,” which were deducted above, because operating expenses cannot be linked directly to the production of the products or services being sold. Overall, a careful review of a bank’s financial statements can highlight the key factors that should be considered before making an investment decision. Investors need to have a good understanding of the business cycle and interest rates since both can have a significant impact on the financial performance of banks.

Deposits are typically short-term investments and adjust to current interest rates faster than the rates on fixed-rate loans. If interest rates are rising, banks can charge a higher rate on their variable-rate loans and a higher rate on their new fixed-rate loans.

Its main activity consists of using money from savers to lend to those requesting credit. This means that a bank’s balance sheet is somewhat different from a company that is not a financial institution. To be sure you’ve got it clear, we have summarized the main characteristics of a bank’s balance sheet below.

Over high interest rate can decline the demand of credit and lead to the decreasing of economic profit so that bank get less net income . A number of empirical studies have documented the balance sheet effect, in particular the finding that the combination of foreign-currency debt plus devaluation is indeed contractionary. It is not appropriate both to restate the capital expenditure financed by borrowing and to capitalise that part of the borrowing costs that compensates for inflation during the same period. Index linked bonds and loans are adjusted in accordance with the agreement. All other non-monetary assets must be restated unless they are already carried at NRV or market value.

Judo Bank pairs with UK fintech in APAC first – Australian Broker

Judo Bank pairs with UK fintech in APAC first.

Posted: Sun, 28 Nov 2021 21:09:43 GMT [source]

The information included in a credit institution’s balance sheet makes it possible to analyze its investment and financing structure, in both absolute values and percentages. Just like accounts receivables and bad debt expense, a company must prepare in the event that borrowers are not able to pay off their loans.

For example, the traditional ratio analysis formula is too simple, which restricts the practicability of the analysis, thus introducing a more complex mathematical analysis method . In order to solve liquidity problems banks financial statements of management for a corporation and make decisions, fuzzy set theory is also introduced in the ratio analysis method. The period of time covered by a financial statement is known as the reporting period.

The reported financial statements for banks are somewhat different from most companies that investors analyze. For example, there are no accounts receivables or inventory to gauge whether sales are rising or falling.

Author: Laine Proctor